CEXs are losing share to new on-chain exchanges.

HyperLiquid is doing it for perps.

@Terminal_fi is doing it for spot trading.

Positioned as the main DEX of the Ethena ecosystem, Terminal will trade USDe, sUSDe, and USDtb (backed by BlackRock’s BUIDL fund)

against major assets like ETH and BTC.

It routes yield from these assets back into its liquidity pools through Yield Skimming. To turn stablecoin yield into deeper on-chain liquidity.

$280M pre-deposited. 10,000 wallets.

DEX launching this December.

Ethena sits between CeFi and DeFi, having reached scale across both markets with a ~$15B TVL through USDe and USDtb — the latter backed by BlackRock’s BUIDL tokenized fund.

Terminal aims to expand alongside Ethena by exporting USDe in a format that TradFi can consume.

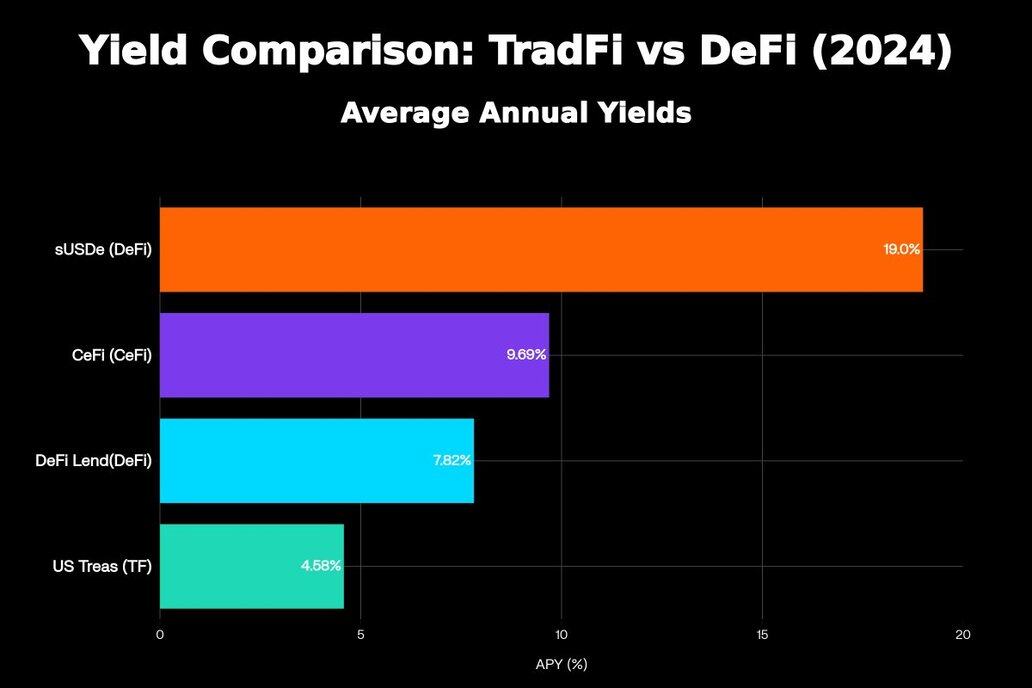

A year ago, sUSDe yielded over 20% in CeFi while DeFi rates stayed near 10%. More than $1B flowed into Aave within days to capture the spread.

In TradFi, capital can often be sourced at SOFR +100 bps, while sUSDe can offer returns above 10%.

This spread represents an even larger opportunity as institutional capital moves on-chain.

Terminal is building the exchange for institutional asset trading powered by USDe, where yield-bearing assets serve as core pairs — launching later this year.

4,931

17

本頁面內容由第三方提供。除非另有說明,OKX 不是所引用文章的作者,也不對此類材料主張任何版權。該內容僅供參考,並不代表 OKX 觀點,不作為任何形式的認可,也不應被視為投資建議或購買或出售數字資產的招攬。在使用生成式人工智能提供摘要或其他信息的情況下,此類人工智能生成的內容可能不準確或不一致。請閱讀鏈接文章,瞭解更多詳情和信息。OKX 不對第三方網站上的內容負責。包含穩定幣、NFTs 等在內的數字資產涉及較高程度的風險,其價值可能會產生較大波動。請根據自身財務狀況,仔細考慮交易或持有數字資產是否適合您。