Crypto ETF Weekly Report | Last week, U.S. Bitcoin spot ETFs saw a net outflow of $1.178 billion; The U.S. Ethereum spot ETF saw a net outflow of $241 million

Finishing: Jerry, ChainCatcher

Crypto spot ETF performance last week

USBitcoin spot ETF net outflow of $1.178 billion

Last week, U.S. Bitcoin spot ETFs saw net outflows for five consecutive days, with a total net outflow of $1.178 billion and a total net asset value of $150.23 billion.

Last week, seven ETFs were in a state of net outflows, mainly from IBIT, FBTC, and ARKB, with outflows of $615 million, $235 million, and $182 million respectively.

Source: Farside Investors

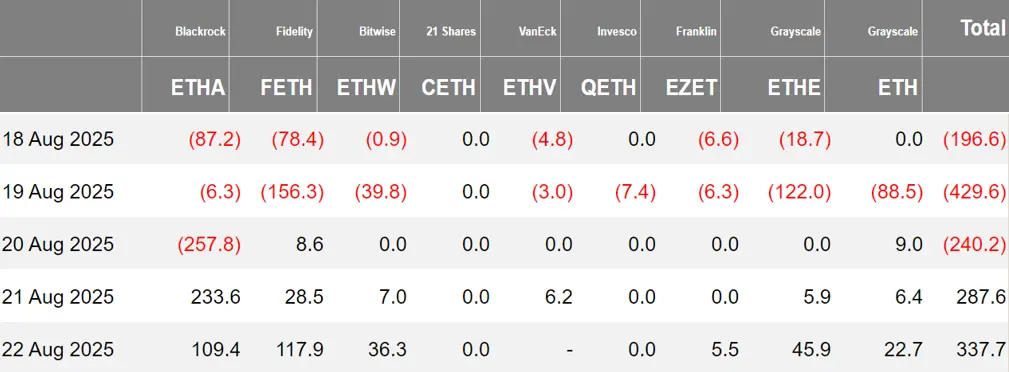

U.S. Ethereum spot ETF net outflow of $241 million

Last week, the U.S. Ethereum spot ETF had a net outflow for three consecutive days, with a total net outflow US$241 million, with a total net asset value of US$26.55 billion.

Last week's outflows mainly came from Grayscale ETHE, with a net outflow of $88.9 million. 7 Ethereum spot ETFs are on net outflows.

Source: Farside Investors The

Hong Kong Bitcoin spot ETF saw a net inflow of 9.89 Bitcoins

Last week, Hong Kong Bitcoin spot ETFs saw a net inflow of 9.89 Bitcoins, with a net asset value of $486 million. Among them, the holdings of issuer Harvest Bitcoin fell to 292.76, and Huaxia maintained it at 2,330.

The Hong Kong Ethereum spot ETF had a net inflow of 1265.34 ETH, with a net asset value of US$121 million.

Data source: SoSoValue

Crypto Spot ETF Options Performance

Asof August 22, the total nominal turnover of U.S. Bitcoin spot ETF options was $2.17 billion, The nominal total traded long-short ratio is 2.97.

As of August 21, the total notional holdings of U.S. Bitcoin spot ETF options reached $23.19 billion, with a nominal total long-short ratio of 1.90.

The market's short-term trading activity for Bitcoin spot ETF options has increased, and the overall sentiment is bullish.

Additionally, the implied volatility is 39.90%.

– >

– >

data source: SoSoValue

Aglance at the dynamics of crypto ETFs last week

Several issuers, including Grayscale, submitted revised XRP spot offerings ETF Application Adds Support for XRP Creation and Redemption

Asset managers Grayscale, Bitwise, Canary, CoinShares, Franklin, 21Shares, and WisdomTree all submitted updated statements on their proposed spot XRP ETFs on Friday, once again indicating the financial firm's eagerness to obtain listing approval from the SEC.

Bloomberg ETF analyst James Seyffart said the filings emerged almost certainly because of feedback from the SEC. This is a good sign, but it is also largely expected.

The updated filing appears to change the structure of some funds, allowing XRP or cash creation and cash or in-kind redemptions, not just cash creation and redemption.

Jito has filed S-1 documents for the VanEck JitoSOL ETF

According to official sources, Jito announced that it has filed S-1 documents for the VanEck JitoSOL ETF, the application is the result of months of working with regulators such as the SEC on policy advocacy, as well as ongoing business development and education efforts by several ecosystem contributors.

The MicroBit Hong Kong Bitcoin and Ethereum spot ETFs are officially listed on the Hong Kong Stock Exchange, with a management fee of 0.5%

According to Yahoo Finance, two virtual asset spot exchange-traded funds (ETFs) under Hong Kong investment management company MicroBit Asset Management (MicroBit) were officially listed on the Hong Kong Stock Exchange, namely the MicroBit Bitcoin spot ETF (Hong Kong dollar counter stock code: 3430. HK, USD counter stock code: 9430. HK), and MicroBit Ethereum Spot ETF (HKD OTC stock code: 3425. HK, USD counter stock code: 9425. HK), it is reported that the management fee of both ETFs is 0.5%.

U.S. SEC delays decision on multiple crypto ETF applications

According to the U.S. Securities and Exchange Commission (SEC), the U.S. Securities and Exchange Commission (SEC) has postponed the approval decision of Truth Social, a social platform owned by Trump Media & Technology Group, to apply for Bitcoin and Ethereum ETFs.

According to Monday's filing, the SEC has extended the approval deadline for Truth Social's ETF to Oct. 8, a regular procedure for the agency to evaluate dozens of crypto ETF proposals.

Alsodelayed on the same day were CoinShares Litecoin ETF, CoinShares Ripple ETF, and 21Shares Ripple ETF, all of which had their decision deadlines extended to late October. "The Commission believes it is necessary to extend the deliberation time in order to fully evaluate the content of the proposal and related issues," the SEC said in the filing. "

21 SHARES XRP ETF is registered in Delaware

Views and Analysis on Crypto ETFs

President of The ETF Store: SEC should not continue to delay approving spot Ethereum ETF staking features

Nate Geraci, president of The ETF Store, issued a statement stating that the U.S. SEC should not continue to delay approving the staking function of spot Ethereum ETFs.

He argued that even if the IRS has not yet issued specific tax guidance for staking rewards, it does not constitute a reason for the SEC to hinder it, as the two are under different regulators. He noted that the feature should have been approved when the spot Ethereum ETF went live.